Unlock Your Business's Financial Potential

Build a strong business credit profile and access funding, better terms, and growth opportunities that personal credit alone can't provide.

Separate business and personal finances

Access higher credit limits and better rates

Protect your personal credit and assets

Build credibility with vendors and partners

Build, Monitor, and Leverage Business Credit—with Expert Support

Our Services: Built to Strengthen Your Business Credit and Unlock Real Growth

Whether you're just starting to build your business credit or you're ready to apply for financing, we offer targeted services to help you succeed—backed by expert support every step of the way.

Credit Profile Audit

Understand What Lenders See Before You Apply

Your business credit profile is your financial reputation—and if it’s inaccurate or incomplete, it could be costing you opportunities.

Why it matters: Lenders, vendors, and leasing companies check your business credit before approving applications. A clean, strong profile increases your chances of getting approved—and getting better terms.

Vendor & Net‑30 Account Setup

Start Building Credit with Trusted Trade Vendors

Vendor credit is the foundation of business credit. We help you open the right accounts with vendors who report to the major bureaus—so you can build credit while buying what your business already needs.

Why it matters: Net-30 vendors are typically the first step in building business credit history without personal guarantees.

Business Credit Building

Build a Strong Credit Profile Tied to Your EIN, Not Your SSN

We walk you through a proven process that takes your business from invisible to investable.

Why it matters: Without business credit, you'll face limited financing, low credit limits, and personal liability for business debts. Most entrepreneurs unknowingly damage their personal credit by mixing business and personal finances.

Credit Monitoring & Reporting

Stay Informed. Stay Protected. Stay Ahead.

Monitoring your business credit keeps you in control—so you can act fast, fix issues early, and stay prepared for funding opportunities.

Why it matters: Credit changes happen fast. With regular updates and alerts, you’re never caught off guard.

Financing Advisory

Get Matched with the Right Lenders—And Get Approved

We don’t just tell you where to apply—we help you get approved. With lender-aligned profiles and smart preparation, you’re ready to secure funding that fits your business.

Why it matters: Each lender has different criteria. We make sure you’re applying to the ones that match your profile—saving you time, inquiries, and denials.

Build Business Credit Without Personal Guarantees

Stop putting your personal credit and assets at risk for business expenses. This step-by-step guide reveals the proven 4-step system to build a strong business credit profile using only your EIN—giving you DOUBLE the borrowing power while protecting your personal finances.

Inside this free guide, you'll discover:

The 4 essential steps to build business credit tied to your EIN,

not your SSN

How to establish business credibility with the 20+ credibility

points lenders look for

Why business credit limits are 10-100 times higher than

personal credit (according to the SBA)

How to get revolving credit from major retailers like Walmart,

Amazon, Best Buy, and more

The timeline to build $10,000+ credit lines in just 90 days or

less

Which credit bureaus to monitor and how to get your

business credit reports

Most entrepreneurs unknowingly damage their personal credit by mixing business and personal finances. Don't make that mistake. Even worse—did you know that lenders review your business credit when you apply for financing? Not having it established will get you DECLINED, and they don't even have to tell you why.

Get Your FREE Guide: "The Entrepreneur's Roadmap to Business Credit: A Beginner's Guide to 'No Personal Guarantee' Financing"

Build credit that's 100% separate from your personal profile and unlock financing opportunities you never knew existed.

No personal credit checks. No personal guarantees. No personal liability.

Smart Financing Solutions for Every Business Stage

Explore Funding Options That Work for Real Businesses

Whether you're scaling operations, investing in real estate, or unlocking liquidity from crypto or inventory—you’ll find flexible, strategic financing here.

Business Lines of Credit

A Business Line of Credit (LOC) provides a flexible financing option that allows businesses to access funds up to a certain credit limit. Unlike a traditional loan, businesses only pay interest on the amount they borrow, rather than the full credit limit. This revolving credit facility helps businesses manage cash flow gaps, finance short-term needs, and cover unexpected expenses.

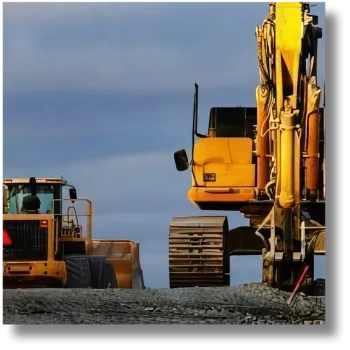

Equipment Loans

Equipment loans provide businesses with the necessary capital to purchase or lease new or used equipment. The equipment itself serves as collateral, meaning businesses can secure financing based on the value of the equipment they wish to acquire. This type of loan is ideal for companies in need of heavy machinery, vehicles, technology, or other operational equipment without disrupting their cash flow.

SBA Loan

This program offers SBA-backed loans for businesses, with funding amounts up to $5 million, flexible terms, and specific requirements for business profitability and personal credit.

Fix and Flip Financing

Fix and Flip Financing is a short-term loan designed specifically for real estate investors who purchase properties to renovate and resell at a profit. These loans are typically used for residential properties that need repairs or upgrades before being resold. The financing covers the purchase price and renovation costs, and is paid back after the property is sold or refinanced.

Crypto Financing

Crypto Financing allows individuals or institutional investors to access liquidity by using cryptocurrencies as collateral. This type of loan is designed for those who wish to leverage their cryptocurrency holdings without the need to sell them. By offering crypto-backed loans, clients can retain their crypto assets while gaining access to immediate funds for other investment opportunities, debt repayment, or other personal or business needs.

Inventory Financing

Inventory Financing provides businesses with the capital they need by leveraging existing inventory as collateral. This type of loan is ideal for businesses that need quick access to cash but do not want to sell their inventory. The loan can help with purchasing more inventory, managing operational expenses, or bridging short-term cash flow gaps. By using inventory as collateral, businesses can unlock liquidity without sacrificing their assets